Summary

Reduce the supply of total SPOOL tokens and create team incentives.

Proposal Option 1

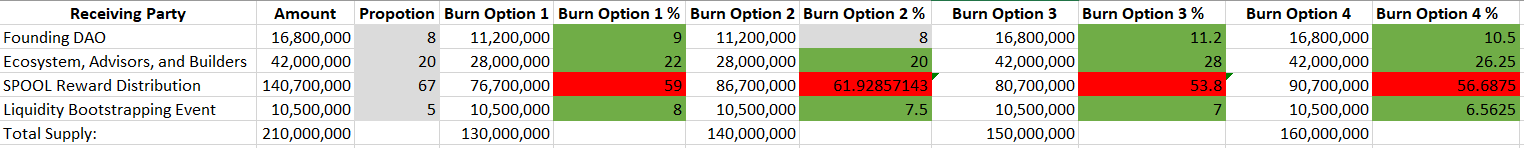

Burn 60,4 million SPOOL tokens from the treasury, 14 million builders tokens, and 5.6 million preDAO tokens, reducing total supply to 130 million SPOOL.

Motivation

The current total SPOOL supply is 210,000,000 of which 42,000,000 are allocated to builders and 16,800,000 are allocated to the preDAO that started off the SPOOL DAO as founding contributors back in 2020.

Currently, ~127,000,000 SPOOL tokens are in the treasury, as yet unallocated. Initially, Spool was supposed to release these tokens as liquidity incentives, but emissions ratios have dropped twice since, resulting in the current reserves being able to sustain emissions for many decades to come.

Aside from selling the tokens, there is currently no use for such a large amount of tokens. Since the price of SPOOL is well below the LBP price, and the runway with current spending is secured until 2026 and beyond, there is no need for these tokens to be liquidated in order to support OpEx.

Builder and preDAO tokens have to be re-adjusted as well to maintain the initial ratios of supply owned.

Proposal Option 2

Same as in Option 1 but retain 10 million SPOOL treasury tokens from the token burn (burn 50,4m instead of 60,4m) to incentivize core team members with vested SPOOL tokens in the future, making the new total supply 140 million SPOOL.

Motivation

Thanks to its successful LBP, Spool DAO secured funds to incentivize new team members with good salaries, however, clear token allocations are missing for new hires to align incentives with regard to protocol success. Additionally, the motivation to bring the best for Spool DAO for every contributor is even more incentivised if the salaries include SPOOL token proportions.

Proposal Option 3

Burn 60 million SPOOL tokens from the treasury, reducing the total supply to 150 million SPOOL.

Motivation

The key difference between this option and Option 1, is the removal of the Builder and preDAO tokens from the supply burn. The rationale for doing so is based on the following:

- Precedent: although limited, there is some precedent for simply burning tokens from the treasury or reserves as several recent, successful proposals have done just that (Merit Circle, Klaytn, Floki Inu).

- Ethics: burning tokens granted to the team (in exchange for work) or sold to investors (in exchange for foundational advice and capital) sets a precedent that, absent a written contract, tokens given from a DAO are subject to repatriation or seizure, even in cases without cause or malfeasance on the team or early contributors’ part. Put simply, it could be perceived as unethical and unsettling for a DAO to allocate someone tokens and then take them away – on the other hand, with this option, the total share of the overall tokens from builders and founding contributors would increase as their part of the share would not be burned, which again, could be perceived unethical and unsettling from another angle. This is the optics risk that should be factored in.

- Centralization Concerns: there should naturally be concerns of increased centralization risk, as the burning tokens from the treasury will increase the relative ownership percentage of all current SPOOL holders (both liquid and illiquid). However, if tokens to be burned were not expected to have been distributed for many decades, then they are, in effect as far as ownership and control are concerned, already functionally removed from the supply and simply burning them would mean all things would remain the same, ceteris paribus. Other past and future DAO decisions affecting protocol emissions, special treasury sells, or alike affect this point as well.

Proposal Option 4

Same as in Option 3 but retain 10 million SPOOL tokens from the token burn (burn 50 m instead of 60 m) to incentivize core team members with vested SPOOL tokens in the future, making the new total supply 160 million SPOOL.

Motivation

The same as in Option 2.

Vote Options

With Option 1 you vote to burn 80 million SPOOL tokens from treasury, builders, and founding contributors,

with Option 2 you vote to burn 70 million SPOOL tokens as in Option 1 and retain 10 million from the treasury burn for future team incentives,

with Option 3 you vote to burn 60 million SPOOL tokens from the treasury,

with Option 4 you vote to burn 50 million SPOOL tokens from the treasury and retain 10 million for future team incentives, and

with Option 5 you vote to not burn any tokens and to not retain new team incentives.

_________________________

The vote takes place here

_________________________

If there should be no simple majority reached in this vote (one option gets at least 50% of the votes), a new vote will be held between the main contestants and then the outcome will be set forth as SIP - 1.35.

Discussions and original texts about Options 1 & 2 can be found here, and about Option 3 here. Option 4 is a logical addition to make all options equally comparable.

Timeline

Voting period: 2023-05-16T22:00:00Z→2023-05-22T14:00:00Z